Our Services

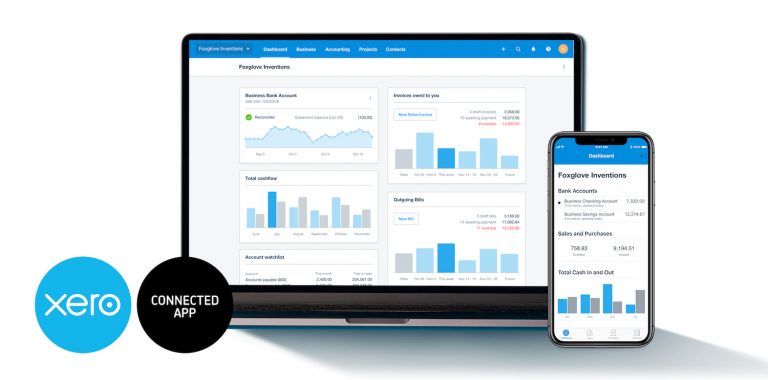

Browse our extensive range of services designed to help you and your business succeed. These range from VAT Returns, Auto Enrolment and Year End Accounts.

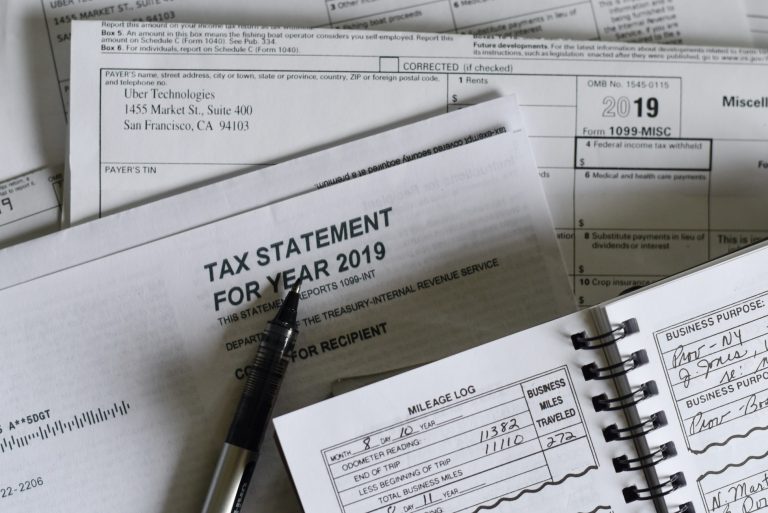

Year End Accounts

Year-end accounts are a statutory requirement for all businesses

A Mind of Figures doesn’t just ensure that your company accounts are filed to Companies House deadlines, but we also ensure that we are forward thinking and make pro-active pre-year end tax calls throughout the year to help and advise your business how to save as much tax as possible, before the year-end passes.

Looking for an Expert Accountant?

CONTACT US NOW TO DISCUSS YOUR NEEDS. A NO OBLIGATION, NO FEE CONSULTATION

- Call Us: 01924 682113